Examples of variable cost are packing expenses freight material consumed wages etc. Fixed costs vs variable costs vs semi-variable costs.

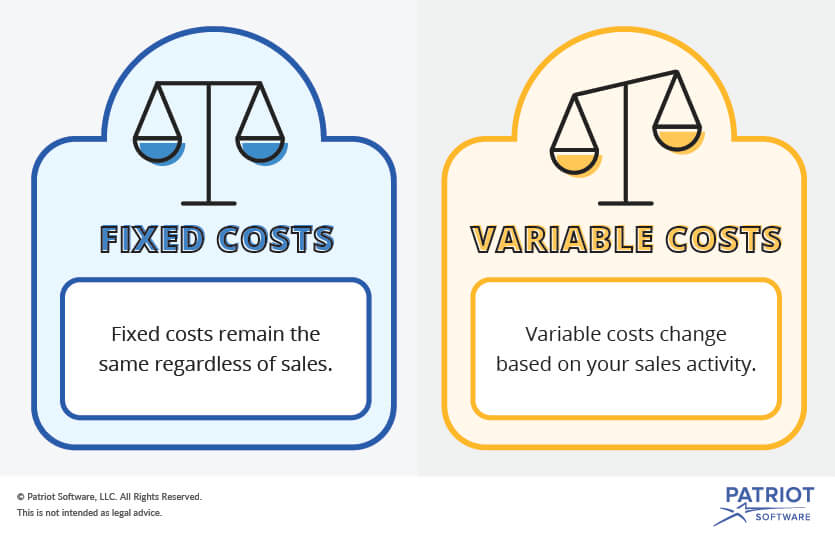

Difference Between Fixed Cost And Variable Cost With Example And Comparison Chart Key Differences

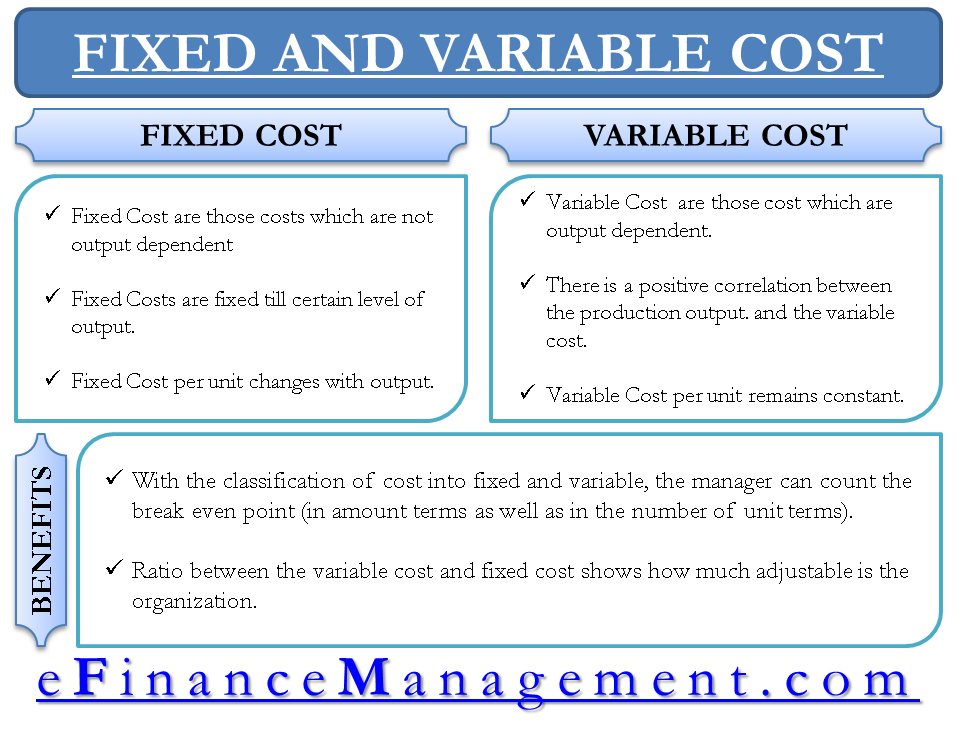

On the other hand variable cost remains constant in per unit.

. Thus fixed costs are incurred over a period of time while variable costs are incurred as units are produced. Break-Even Analysis The knowledge of the fixed and variable expenses is essential for identifying a profitable price. The cost associated with having the service ex.

Another example of mixed or semi-variable cost is electricity bill. Variable costs change based on the amount of output produced. Variable cost remains.

Fixed costs remain constant regardless of the level of output by the company. Fixed and variable costs also have a friend in common. Fixed cost is more or less constant over a period of time while variable cost increases and decreases at regular intervals.

7 rows Fixed costs do not change with increasesdecreases in units of production volume while. Fixed costs stay the same no matter how many sales you make while your total variable cost increases with sales volume. Unlike fixed costs variable costs do increase or.

If your income is high fixed costs appear to consume less of your income while if your income falls fixed costs can put you out of business or drive you to bankruptcy. Its much easier to budget for fixed. Fixed costs remain the same regardless of production output.

The sum of fixed and variable cost. Fixed cost is defined as a cost that does not change its value with any change Increase or Decrease in the goods produced or services sold. They dont change regardless of your business activity so no additional calculations are needed.

11 rows Fixed cost decreases with an increase in the number of units produced. The major difference between these two costs is that the Variable depends on the output of production while the fixed cost is independent of the output. Variable costs are charged to production costs.

A change in your fixed or variable costs affects your net income. Examples of fixed costs include rentmortgage insurance salaries interest payments property taxes and depreciationamortization. Fixed cost changes in per unit.

Variable Cost Identification Variable costs are flexible costs that rise and fall according to the economic environment or actions you take. Fixed cost doesnt change when the output changes but variable cost does. Why Is It Important to Distinguish Between Fixed Costs and Variable Costs.

Rather it is charged to the contribution margin. Fixed cost is regular as it needs to be paid to sustain the company while variable cost is incurred as per the productivity of a company. Variable costs change in direct proportion to.

The major lesson here is that in spite of their name fixed expenses are not necessarily. The 500 per month is a fixed cost and 5 per hour is a variable cost. Monthly fee for phone serve variable costs.

Difference Between Fixed vs Variable. For instance if you have a five-year lease on. Main difference between fixed and variable cost.

Fixed expenses cost the same amount each month. Variable costs are the costs that do vary with the level of production. This difference is a key part of understanding the financial characteristics of a business.

For example the rental charges of a machine might include 500 per month plus 5 per hour of use. Calls placed long distance internet connection. All the costs like production administration selling and distribution costs are classified into a fixed and variable cost.

Heres a look at the primary differences between fixed and variable costs. The difference between fixed and variable costs is that fixed costs do not change with activity volumes while variable costs are closely linked to activity volumes. It also affects your companys breakeven point.

Represents the portion of the charge for actual use ex. Fixed costs do not change with the amount of the product that you produce and sell but variable costs do. Variable costs may include labor commissions and raw materials.

Examples of fixed cost are rent tax salary depreciation fees duties insurance etc. Taken together fixed and variable costs are the total cost of keeping your business running and making sales. Fixed costs remain the same from month to month while variable costs are always tied to production levels and can vary based on current production.

Fixed costs are the simplest of the three. Definition of Fixed Expenses. Fixed costs typically include such things as the rent on the building in which the firm produces its product.

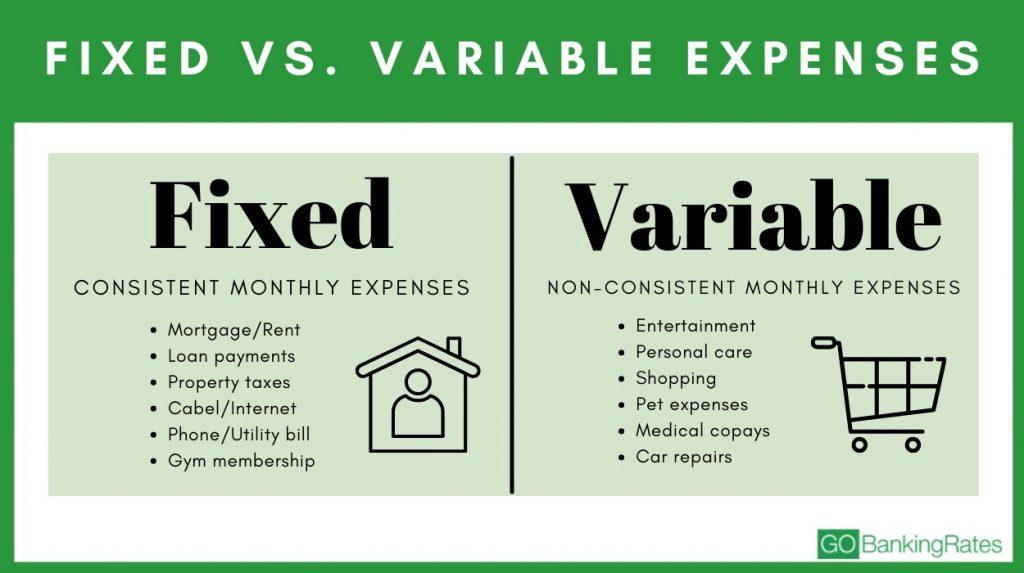

Whats the Difference Between Fixed and Variable Expenses. Saving on Fixed Expenses. A cost that has the characteristics of both variable and fixed cost is called mixed or semi-variable cost.

Fixed costs are not charged to production costs.

Fixed Expenses Vs Variable Expenses For Budgeting What S The Difference Gobankingrates

0 Comments