You receive a tax invoice. You should use the Discounted Sale Price Scheme.

Can I Claim Gst On Car Insurance In 2022 Car Insurance Insurance Canning

Betty is registered for GST and holds a car insurance policy with ABC Insurance.

. Effect of GST on Car Insurance. The insured business claims the GST back from the taxation department as a credit when filing the next GST return. If you were not eligible to.

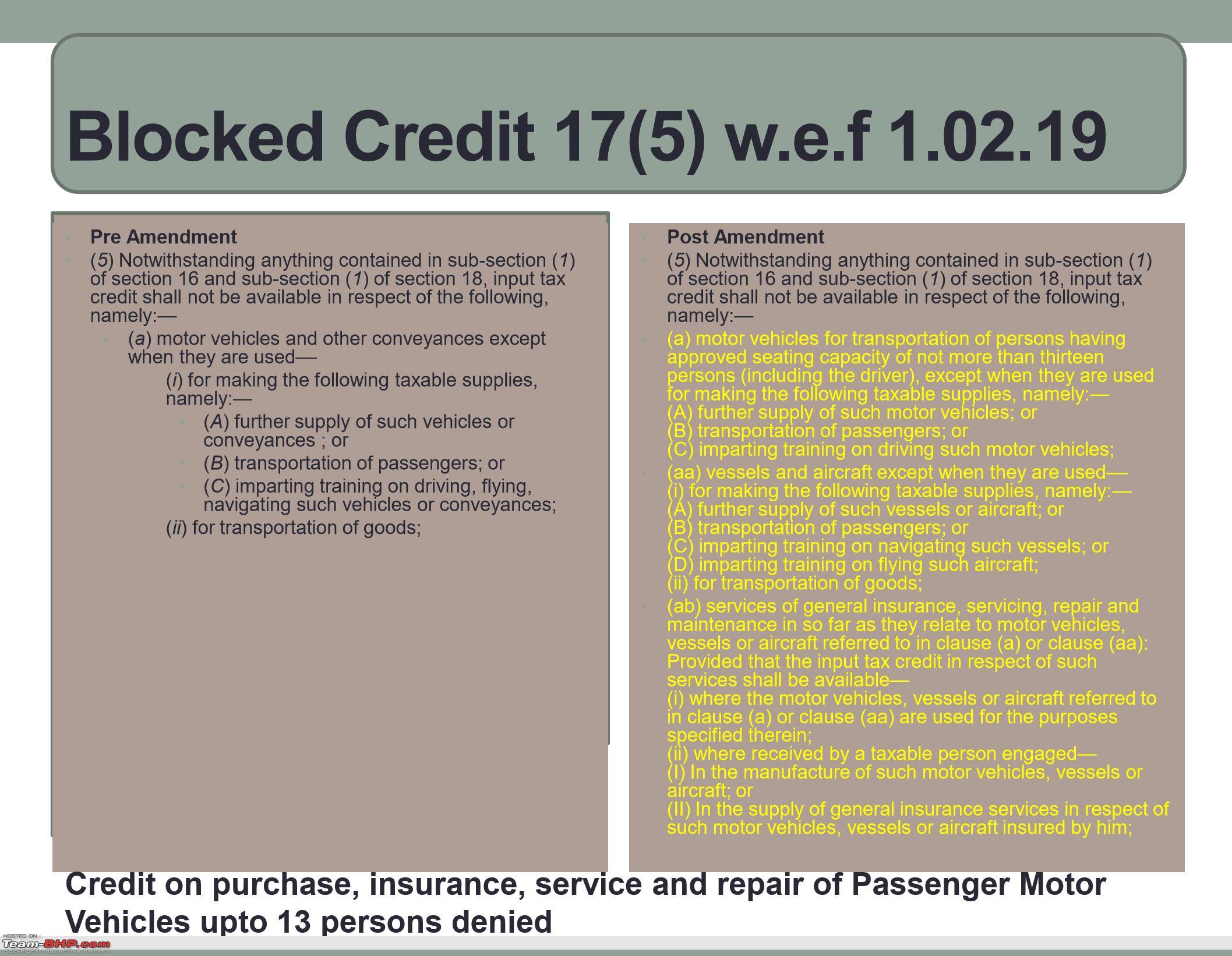

Applicable GST on Commercial Vehicle Insurance Policy in India. The motor insurance company. The Credit of such Vehicles which have capacity less.

Where the Insured is registered for GST generally the insurer on settlement of a claim will not pay the insured the GST portion of. Rajat Mohan Partner AMRG Associates says Section 80C and Section 80D of Income-tax Act entitles specified taxpayers to claim the deduction for the entire amount paid. The increase in the applicable tax on car insurance from 15 to 18 GST does impact your premium adversely.

The Insured must declare their of ITC at the time of a claim. She tells ABC she can claim a 100 GST credit for the GST included in the policy price. Betty has a car.

General insurance for the business. Simply add up the GST you paid on business expenses and subtract it from the GST you collected on sales learn more in working out your GST. Impact of GST on Car Insurance Premium.

Yes you are required to charge GST on the sale of your company vehicle even though you did not claim GST on the purchase of the vehicle. For example if a car is involved in an accident and the cost of. You cant claim GST credits on any excess that you pay to your insurer.

The Vehicles having the sitting capacity of more than 13 passengers the taxpayer is eligible to claim ITC of that Vehicles. The party you pay is not acting as an agent for your insurer. Besides that the financial cover offered by any type of motor insurance is one of the main benefits for the insured.

For the insured person to be entitled to claim an ITC in respect of the GSTHST paid or payable on the acquisition of services or property all requirements for claiming an ITC must be met including the requirements that the insured person be a GSTHST registrant that the property be for consumption use or supply in the course of the insured persons commercial activities and. GST paid on general insurance is available if expense is for the business purpose. As an administrative concession input tax can also be claimed on public liability insurance.

Whether you are buying car insurance or two whe eler insurance. If you pay an excess to someone other than your insurer you can claim a credit on any GST paid if. However as per the GST it is at 18.

So GST on insurance premium paid for factory building motor vehicle fire insurance etc will. Report the amount of the excess at G11 non-capital purchases or at G10 capital purchases. Every commercial vehicle insurance attracts Goods and Services Tax GST as you are purchasing a service.

Therefore the business will only be out of pocket the GST exclusive amount of 10000 and this is the amount the insurance company will pay. Input tax claims are allowed on general insurance expenses eg. Yes GST Mechanism is applicable in Insurance General Insurance Claims too the application in case of accidental repairs or repairs which are covered in Insurance policy GST is applied if the.

Car or vehicle insurance premium attracted 15 as Service Tax under the previous taxation system. Fire insurance burglary insurance machinery risks insurance trade cargo insurance subject to the conditions for input tax claim. When expenses are split between business and.

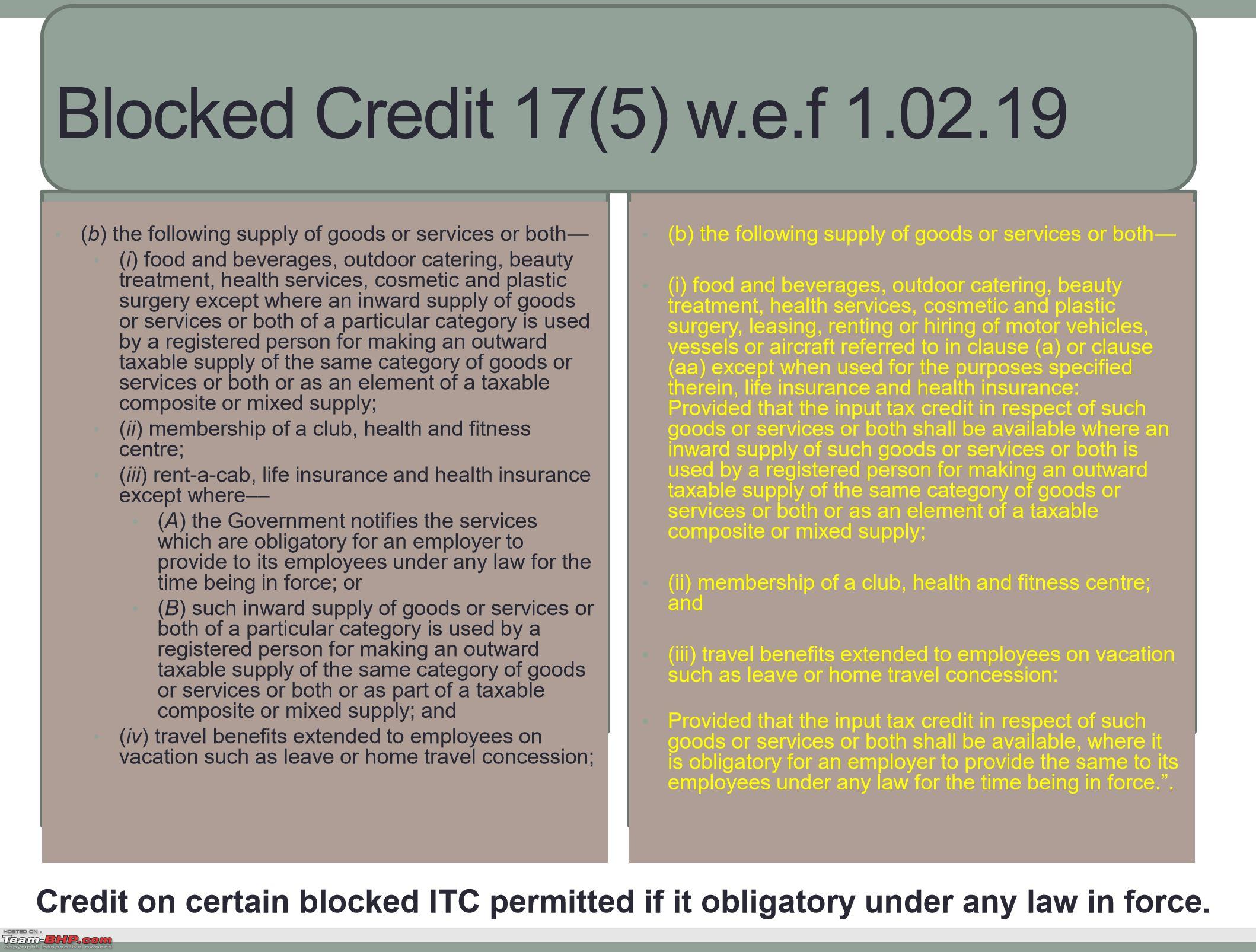

Gst No More Input Tax Credit On Automotive Invoices Purchase Insurance Service Repair Team Bhp

What Is The Impact Of Gst On Car Insurance Policies

Gst No More Input Tax Credit On Automotive Invoices Purchase Insurance Service Repair Team Bhp

0 Comments